On 23 July 2021, The NGO Forum on Cambodia co-organized with Fair Finance Cambodia to host Discussion on Social and Environmental Safeguard Policies and Systems of Interbank and Financial Sectors to Protect People Living in or around the Development Projects Areas which fund supported by Swedish Citizens’ Aid, Diakonia and Oxfam in Cambodia. This meeting hosted via online meeting (Zoom) which participants joined in the discussion including key guest speakers and stakeholders from the government line ministries/institutions including Ministry of Economy and Finance (MEF), Ministry of Environment (MoE), National Bank of Cambodia (NBC), Securities and Exchange Regulator of Cambodia (SERC), development partners such as World Bank, private sectors like Association of Banks in Cambodia (ABC), Agricultural and Rural Development Banks of Cambodia (ARDB), Cambodia Microfinance Association (CMA) & other commercial banks such as Bank of China, Industrial and Commercial Bank of China (ICBC), independent academia/researchers such as Royal Academy of Cambodia (RAC), National Institute of Agriculture Prek Leab, CSOs, grassroots communities, especially youths.

Welcome Remark by Dr. Tek Vannara – Executive Director of The NGO Forum on Cambodia, inform you all that the NGO Forum on Cambodia is a membership organization having eight secretariats to facilitate with all members and the public to have chance for discussion and contribution to the public-private engagement at the national and sub-national levels in order to seek for appropriate resolutions to achieve the sustainable and inclusive development goals. With our members, we would like to see all Cambodians live in peace and enjoy the equitable, inclusive and sustainable development in Cambodia. In order to achieve this vision, NGOF focuses on its mission to facilitate and build capacity of the NGO members, civil society and relevant stakeholders to able to join discussion, policy development to assure the sustainable development.

Cambodia has contextualized the sustainable development goals into Cambodia sustainable development framework since 2018. Two pillars among the five are people and planet including environmental and social governance principles to contribute to economic and sustainable development. To achieve this, the Royal Government of Cambodia and particularly the Ministry of Environment has signed MoU with the National Bank of Cambodia as a positive sign for green financing in Cambodia. Ministry of Economy and Finance has strived to develop a standard to assure provide appropriate resettlement resolutions for development projects, contributing to the sustainable development. At the same, the finance and banking sector plays important roles and is a mechanism to sustainability. The assurance of the cash flow is essential to increase the economic activities among the people as they are working and earning a living. The rapid increase of banks and microfinance institutions in Cambodia in the last few years is a proof of increase of economic activities including the investment and development projects as proposed based on the development policies of Cambodia. Concretely, development generates both positive and negative impacts over social and environmental resources. So, the participation of finance and banking sector to provide loan is important. As so far, there have been good practices, but also some insufficiencies to check and monitor the impacts on society and the environment. Such impacts not only degrade the resources, but also affect the projects, causing its failure to pay back to banks. Based on the recent study on compliance of EIA in finance and banking sector in Cambodia by independent research, it recommends some key policy options to encourage banks and related stakeholders in promoting the sustainable development in Cambodia.

In spite of banks, there are some actors facilitating the financial sector in response to the development and growth of macroeconomic and social sectors. Among others, the Cambodia Stock Exchange plays essential roles as a member in supporting the environmental and social governance principles in mainstreaming the UN’s principle on people and business. So, to understand the policy implementation towards sustainability in ESG framework, there requires an in-depth study especially on green financing about how polices and regulations are implemented. For environmental sector, we have observed that there are some key regulations such as Law on Environmental Protection and Natural Resource Management in 1996, sub-decree no. 72 on EIA in 1999, Prokas no. 376 on general guidelines for preparing EIA reports in 2009, Prokas no. 21 on classification of development projects requiring EIA in 2020, and other related sub-decrees on pollution control and Prokas on resettlement committee. There are other key regulations to enable effective discussions and resolutions for resettlement compensation for development projects. These mechanisms are vital to allow spaces for relevant stakeholders to discuss to seek for resolutions and contribute to sustainable development and to ensure that stakeholders equally benefit from the development. For our civil society organizations, we would like to see actors in finance and banking sector consider more about the environmental and social concerns. Banks provide loans and therefore could impose some compliance to any social and environmental risks from using the loans and to address the concerns of the people living in and around the development projects. Consultative mechanism is beneficial to assure that their loans grow and can build their credits of banks among the public for the sake of environmental protection, and revenue gains. Environmental management and restoration plan shall also be incorporated into some certain requirements from banks to loaners to contribute to the sustainability of the planet.

Open Remark by Mr. Sok Khim, Oxfam Cambodia

Oxfam is keen on working with private and financial and banking sector in the globe to assure that their impacts are avoided or minimized and that development is sustainable. In Cambodia, Oxfam is implementing Fair Finance Project which is a regional project and being implemented in 12 countries including Cambodia. We started the project in 2018. The project engages private and financial and banking sector and works with them to ensure that their investments and loans could reduce the risks on environment and communities in and around the projects. We also support investors to implement their appropriate policies and actions to reduce unprecedented negative impacts. In this Fair Finance Project, Oxfam has established an alliance having some NGO members including NGOF, CCC, ActionAid Cambodia, Transparency International Cambodia. We also have NGO Observers – SILIKA and UN Human Rights.

The objective of the Fair Finance Alliance is to promote investments and private sector who receive loans from financial institutions and banks to implement policies that could reduce risks on environment and push for good governance in development projects. Through the Alliance, we have built capacity of financial and banking institutions, policy-makers and civil society organizations to make them fully aware of the national and international guidelines and standards that have been approved and practiced especially the principles of ESG to enable those institutions to internalize their projects’ impacts when they are performing their projects.

Panel Discussion, moderated by Mr. Ouk Vannara and Mr. Mar Sophal, NGOF

1- Mr. Men Pheakdey, NBC Representative

2- H.E Dr. Phen Sopheap, Advisor to MoE from NIA Prek Leap

3- Ms. Kruy Narin, GD of Policy, Ministry of Economy and Finance (MEF)

4- Mr. Kep Samphy from SERC

5- Ms. Elsie Gung, DCEO of Bank of China & ABC Representative

6- Mr. Ea Sophy, Senior Environmental Specialist, World Bank

7- Mr. Lin Shiqiang, President of Industrial and Commercial Bank of China (ICBC)

8- Mr. Chan Seyha from ARDB

9- Mr. Kaing Tonggy from CMA

10- Ms. Dr. Prum Tevy from RAC

11- Dr. Sam Chanthy, Independent Researcher

12- Mr. Hong Reamksmey, ActionAid Cambodia

13- Mr. Norak from CCC

14- Mr. Ra Chanroath, Transparency International

15- Dr. Seng Sovathana, Diakonia

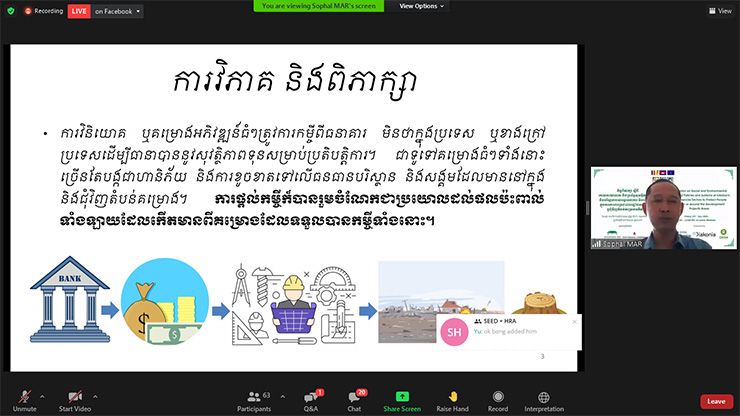

Brief Report Presentation by Mr. Mar Sophal, Program Manager

Large investment or development projects require loans from banks either in and out of Cambodia in order to assure their capital security for operation. In general, these projects cause risks and damages on environmental and social resources in and around the project sites. Loaning contributes indirectly to impacts from the financed projects.

For environmental protection policy and in the context of environmental and social impact assessments, Cambodia’s legal framework has not yet been given the attention to promote environmental and social issues and natural resource protection in banking and finance sector. The legislations that have been enacted in the past aimed at sharpening technical work and improving the efficiency of management of environmental and social impact assessments, with specific guidelines from the Ministry of Environment. There is no legal basis or provision for the inclusion or integration of this assessment in the policies and practices of banking and financial institutions in Cambodia.

The work between the Ministry of Environment Association of Banks in Cambodia and the National Bank of Cambodia on the consolidation of environmental protection in the banking and financial sector has not yet found a clear and detailed starting point for the relationship on this work, other than a memorandum of understanding held between the Ministry of Environment and the Association of Banks in Cambodia in 2019. Furthermore, this memorandum has not been implemented or has done something clear so far.

The association is highly committed to prioritizing the values of environmental and socio-cultural resources through impact assessment, management and prevention of causes and effects, avoidance and mitigation of risks or adverse effects, which may result from commercial activities, standards or transactions of customers who have received finance from the bank. These are just some of its principles that are voluntary-based, but they are not yet worth considering, which can drive the legal need for members to implement them.

In general, loan purpose is to determine if a project will use the credit for something that could cause environmental and social harm. The thorough scrutiny of this purpose will prevent or reduce the use of funds in the direction that the bank prohibits or that may cause conflict, damage, or destruction of the country’s environmental and social resources and local people. Loan evaluation shall be based on the Prokas no. 021 dated on 03 February 2020 on classifications for projects requiring EIA.

It has been so far practiced that project owners or clients who have received loans or credits from international or regional banks (such as the Asian Development Bank, the World Bank, or the International Finance Corporation) have diligently studied and prepared environmental and social impact assessments in order to meet the absolute need to fulfill the rightful conditions of those banks.

The needs of these banks reflect the recognition of concerns about environmental-social issues and long-term sustainable development that are becoming active topics in the context of development.

The results of the study clearly show that banks in Cambodia do not have specific policies and practices regarding the need for environmental and social impact assessments on projects that receive loans from banks and other financial institutions. Contrary to what has been done for regional and global banks, such as the Asian Development Bank and the World Bank or International Finance Corporation, that require environmental and social impact assessments for projects.

The lack of enforcement of environmental and social safeguards in the banking and financial sector in Cambodia is a major concern as credit from this sector has contributed extensively to many developments or investment projects, some of which have resulted in damage or conflict with the local resources of the people.

This shortcoming reflects the current needs in considering the environmental impact assessment of the loans or credits given to the development or investment projects.

Recommendations

– Shall have the joint-declaration on the requirements of the environmental and social impact assessment report for the banking sector in Cambodia and execute the Declaration no. 021 PRK.BST dated 03 February 2020 on the classification of environmental impact assessment for development projects.

– Under the financial and technical assistance from its partners, the Ministry of Environment, with the Department of Environmental Impact Assessment as its general staff, shall develop additional guidelines on required procedures and operational standards for environmental and social impact assessment that can be implemented with the banks in Cambodia. This procedure and standard include a joint-declaration (between the Ministry of Environment and the National Bank of Cambodia) on the requirements for social and environmental impact assessments in the banking sector, and a handbook on legal standards regarding environmental-social impact assessment, and procedures for monitoring and approving the environmental and social impact assessment report, the process of public participation in the environmental-social impact assessment study, the environmental observation, and some administrative formalities (i.e. Rapid Assessment Matric for classifying environmentally risky loan projects), which can facilitate the bank’s performance in implementing environmental and social impact assessment requirements on consumer loans.

– Banking and financial institutions need to continue to strengthen and operate more thoroughly before approving loans, emphasizing the procedures for evaluating and controlling loans and monitoring loan operations at a later stage.

– Ministry of Environment and the National Bank of Cambodia should provide guidance through a number of policies and implementation tools (such as relevant technical guidelines) to the lending bank, requiring the lender to establish an Environmental and Social Management System (ESMS) for its institution to ensure that environmental or social issues or risks which may result from the use of bank loans will be avoided, reduced or compensated for irreparable damages.

Wrap up and closing remark, by Dr. Seng Sovathana, Diakonia Cambodia

My greeting to all participants. Now we come to an end of our discussion. On behalf of the organizing committee, we are honor to join with you all and especially for the closing remark of the discussion. We appreciate your presentation, actual experience sharing, active participation and feedbacks and recommendations for better directions of the development particularly the preparation of the policies, regulations and guidelines for environmental protection for the benefits of the country and the people. Through my observation on the discussion, we understand clearly about the practices of policies and social and environmental safeguard framework of the interbank and institutions in relation to the loans and grants for development in Cambodia. We learn the key ideas and visions that could be further actualized to respond to the sustainable development goals in Cambodia and the globe including the ESG and to promote local economic development. In the spirit of active discussion, we have collected ideas, concepts, visions of the interbank and financial institutions in relation to social corporate responsibility in order to assure the best practices for the people and for the further growth.

Due to time constraint, we will not summarize this discussion. One of the key messages we have noticed and that could be repeated by CSOs and private sector is to understand the needs and supports for women, children, youth, indigenous people, disabled persons and LGBT to restore the policy implementation and social and environmental safeguard systems. At this point, it may be a bit complicated for the work of social and the environment. Though it is hard, but we manage to share with you our vision that when we can fulfill the needs and supports for these groups of people especially women and children, it means that we discuss about the equity, equality, social well-being and sustainability and the healthy planet. They will be able to join in the decision-making process and share their ideas in the discussion on their actual needs. Moreover, when we take into serious account of needs of women and children, it means we provide benefits for the two generations of human being. The older generation must contribute into good practices to be good model heritage for younger generations. Older generation will be blessed by God so that the later generations are satisfied. For example, interbank and financial institutions can provide low-or-no interest loans or share any part of its revenue to support these people which also parts of the CSR. Thus, we must prepare our action plan for good cooperation between interbank, CSOs and local people for further joint efforts in the context of equity, equality, well-being and sustainability for social and environmental safety system in Cambodia. We have seen and hoped that the results from the discussion will better off the policy implementation and social and environmental safeguards that could strengthen the efficiency and effectiveness of CSR and contribution from all relevant stakeholders in order to fulfill the needs of people to live with dignity.

Before end, we thank you panelists, moderators and all participants for their active participation for the whole morning. Your engagement provides us opportunities to learn and share good experiences and key ideas for further program or project implementation with success. Thus, we continue to commit to partner with both public and private sectors and the CSOs. We thank for the financial support and collaboration from Oxfam, Diakonia, Sweden, Fair Finance Cambodia and other NGO partners for organization of the discussion today. We wish to thank the working group of the NGO Forum on Cambodia together the translator, technical support team and media for their effort to organize and disseminate the key discussion smoothly. We wish you all safe and free from COVID-19.